In honor of April being National Distracted Driving Awareness Month (we promise it’s real), let us tell you about Claim Toolkit for Auto. But first a story – which may or may not be true. You decide!

A college student was driving through a campus parking structure, going around and around to get to the bottom exit. She took a turn a little wide in the narrow structure and collided with another car coming up the parking rows. Thankfully, no one was hurt, it was just a little fender bender on the front left bumper of each car. No one was around to witness and no cops were called. Who was at fault?

Who decides who’s at fault? What questions do you ask to determine who’s at fault?

In this scenario, the girl coming down was at fault (she was going too fast and taking those turns too wide) but the claim was deemed 50/50. Could this have been ruled differently if more questions were asked? Was someone looking at their phone? Maybe reading comments on a graded paper they just got back? Or talking to a passenger about the happy hour they are going to?

Maybe this is a true story, maybe it’s not, but we’re sure as a claim’s adjuster -or anyone in the P&C insurance field – you’ve heard thousands of stories similar to this one.

It’s not a surprise – there are all kinds of distractions these days. April has even been declared National Distracted Driving Awareness Month! Are you capturing all these distractions with the questions you ask when a new claim comes in?

Did you know that 34% of all crashes have more than one driver at fault? What’s your percent? If it’s 10%, that could mean you’re giving out money that you shouldn’t!

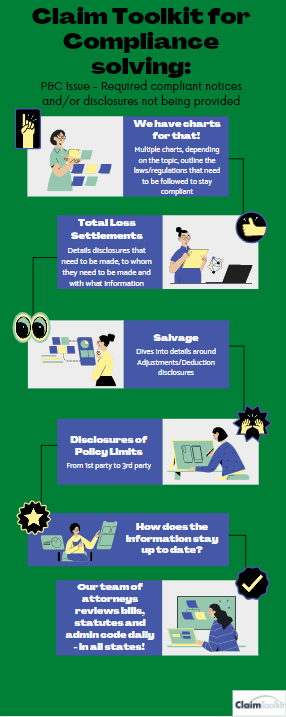

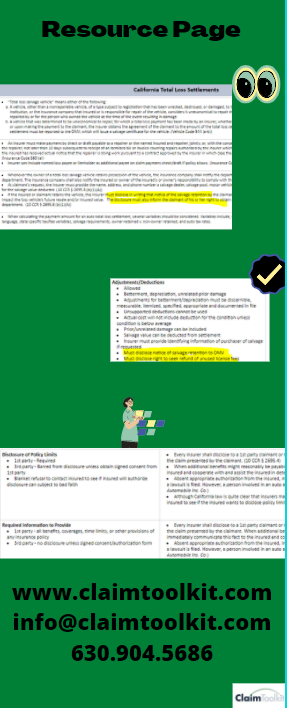

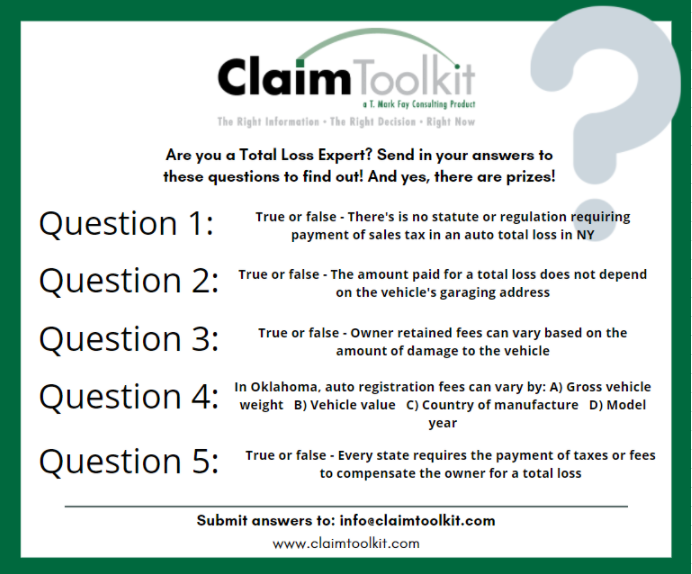

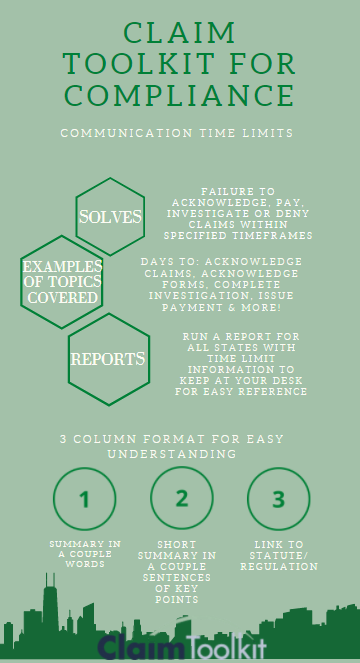

Claim Toolkit for Auto provides accident type tips and evaluation techniques to improve claim rep skill. We give fast, accurate assessments of realistic ranges for settlements. Don’t pay out more money than you have to! I bet if you were to do a cost analysis, the cost of this product wouldn’t even be a blimp on the radar to how much money your company could be saving. Don’t worry – we can help with that. We even help with training claim reps!

Maybe your company would have won this claim in the scenario above and not have had to pay anything out. What do you think? Well, if you had Claim Toolkit for Auto then yes, maybe you wouldn’t have had to pay anything because you had the software to ensure you were asking all the right questions and your adjusters have been trained on evaluation techniques. Just think….have you been giving away unnecessary money? That’s a thought that could keep you up at night! But don’t let that thought distract you while you’re driving – or we’ve taught you nothing today:)