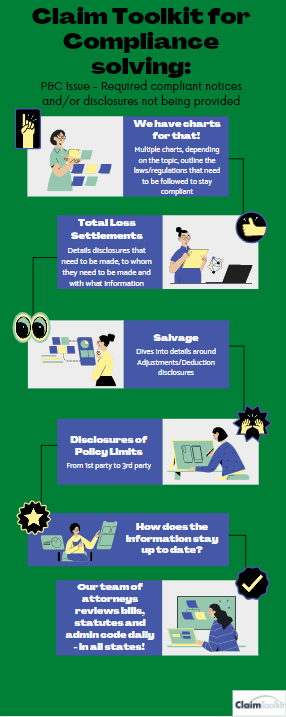

As we continue to solve the top insurance problem, this week bring us to: Required compliant notices and/or disclosures not being provided.

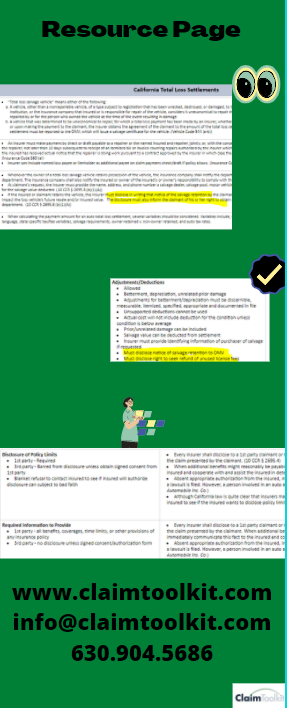

An adjuster has all kinds of disclosures to worry about: total loss settlements, salvage, and policy limit disclosure, just to name a few. So as of today, how do they keep track? Well, it seems that most aren’t which is why it’s a top problem!

At Claim Toolkit, we keep all our information up to date by staying in the know. One of the ways we do this is by looking at market conduct exams, talking with customers and reading articles. We’ve been seeing and hearing P&C insurance problems that have easy solutions to them so we want to help!

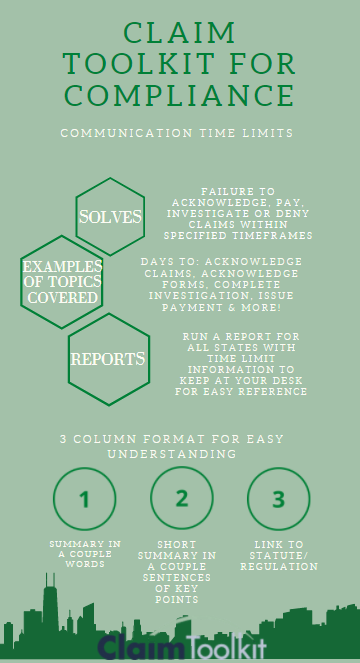

We are going to kick off with: Paying, investigating, acknowledging and/or denying claims outside of the specified time frames.

We’re sure that no is surprised that this is a top issue for insurers! As an adjuster, how many time frames do you need to keep track off? That’s why Claim Toolkit for Compliance create a Communication Time Limits chart.

This is one of our most popular charts as it outlines time frames for everything you need to know when handling a claim – in every state, plus DC.

How many days does the insured have to make proof of loss after a blank form is supplied by the insurer? For North Dakota, its 60 days

How many days does an insurer have to make a decision on claims/benefits within receipt of a valid and complete claim? In Colorado, 60 days

Claim Toolkit for Compliance can’t ensure that you meet these time frames, but we can give you all the information you need to try!

It is amazing the amount of information a claim’s adjuster needs to know. I see all the information we have in Claim Toolkit for Compliance and it blows my mind that one person needs to know all this information to handle a claim! Let alone, handle different types of claims in different states that have different laws.

When I started working in the property and casualty insurance realm, I looked for a class that would give me an overview of what a claim’s adjuster needs to know. Surprisingly, it’s a very hard class to find! So, if you are a new adjuster or if you’ve switched territories, what kind of training do you get? Do you have a cheat sheet that the company provides or is passed down from another adjuster? Is your desk covered in sticky notes?

Would it be handy to have a chart with specific information by state? For example, a chart with the med pay laws in Alaska? Or, a chart that details the laws around fraud in California? Claim Toolkit for Compliance has just this! I have learned SO MUCH by typing in key words in a search bar and having a chart populate based on that key word. Then, I select the chart I want to see the laws and regulations around the topic in a way that I actually understand.

Yesterday I met with a manager to give a demo of this product. Multiple times she said, “I wish I had this product over the last 20 years. It would have made my life so much easier!” I think we all do.

Some examples of our top utilized charts are: General Duty of Care, Statute of Limitations, Communication Time Limits, UM/UIM and No Pay/No Play laws. This is just the beginning – we have over 60 different charts of information! If you are a new adjuster or new to a territory, we have a chart that is a made for you – State Compliance Overview. This gives you the top regulations you need to know when assigned a new state. Best part about this, you can download the chart and print it off. Just hang it on your wall by your desk to easily reference it at any time. *We do recommend reprinting it weekly as we are always updating the information with the newest regulations.

You tell us, as a claim’s adjuster, what is it that you need to know? How do you find that information? For Claim Toolkit, if we are missing information that you’re looking for – we add it! Just think…how much time could you be saving by entering a word into a search box to find the information need? How much faster can a new adjuster get up to speed? I’m going to leave those questions there for you to ponder…

On our website it states that our applications are updated over 20 times every business day with new laws and regulations. A common question we get it – is that true? It is! It’s probably double that at the moment with all the changes in each state due to COVID. The follow up question to that is – How?

Our typical response is that we have a lot of spreadsheets! But now we think it’s time for us to give you a behind the scenes look on our updating secrets. Are you ready?

1. We do have a lot of really good spreadsheets that we work off of. They can overwhelming at times because of the amount of information on them but they are an amazing tool. I’m sure you’re thinking…what information is on them? Great question! For each state, we keep track of active emergency orders and directives with the expiration dates and the corresponding links to websites where they information is kept. EVERY SINGLE DAY we go into that website and see if any new regulations have come out that impact the P&C insurance industry. Our spreadsheets keep track of expiration dates so we know when a regulation is expiring and know to look to see if there’s an extension. Yes, we do this every single day!

2. We have a compliance team. Companies that have lawyers typically have lawyers to protect their business, but our team is a little different. Our team of attorneys review laws and decide which ones are applicable in our industry and then put them into simple terms for anyone to understand. Again, updating our applications for any changes in laws or enhancing our products by adding new content! Here’s a secret…what is an attorney’s least favorite season? Bill season! Could you imagine having to read 100 bills that were just signed to find what impacts the P&C insurance industry? Woo, what a job our team has!

3. Our entire team is dedicated to keeping up with changes that impact claims adjusters. It’s our full-time jobs! Every day we check governor’s news, state news, etc. to see if there is anything that our customers need to know. If so, we update our applications! It really is a full time job keeping all the information up to date. Claim’s adjusters have to know so much and work with customers everyday, so we pride ourselves on keeping information up to date so an adjuster can just hop on the application and find their answer – quick and easy! Hunting down laws and regulations shouldn’t be what they spend hours doing. That’s why Claim Toolkit was invented!

So yes, we really do update our applications over 20 times a day! I think most of us at Claim Toolkit have learned more than we ever thought possible about P&C insurance laws and regulations because of this! Why hunt down the information if we already have it in a database, ready to go? Out motto is, “Your team needs the right information so they can make the right decision, right now,” – and now you know how we hold true to that!