This week we are getting into one of the biggest challenges: Processing total loss claims correctly.

We actually had a customer approach us with this problem and asked us to come up with a solution. At first, we didn’t think is was possible but Claim Toolkit for Auto Total Loss Tax & Fees was born!

It has taken us years to perfect this product but now we can say with confidence that Claim Toolkit for Auto Total Loss Tax & Fees is your solution to handling total loss claims properly. Out of all of our products, this one has been the most popular this year. Why? because everyone has this problem but there aren’t many solutions out there!

We calculate tax and fees so you know exactly what is owed for a total loss, no matter the garaging address. We even have team members dedicated to keeping the taxes and fees up to date and making sure all the calculations run smoothly.

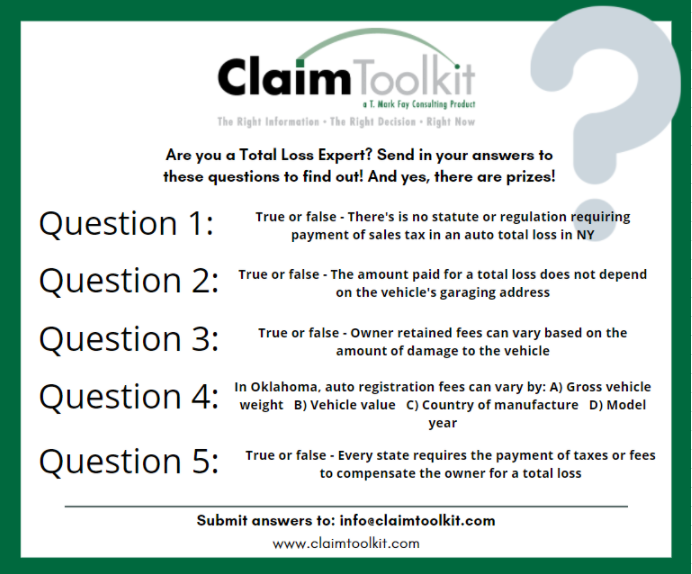

Do you think you’re a total loss expert? Send us your answers to these questions to find out (no cheating!):

At Claim Toolkit, we keep all our information up to date by staying in the know. One of the ways we do this is by looking at market conduct exams, talking with customers and reading articles. We’ve been seeing and hearing P&C insurance problems that have easy solutions to them so we want to help!

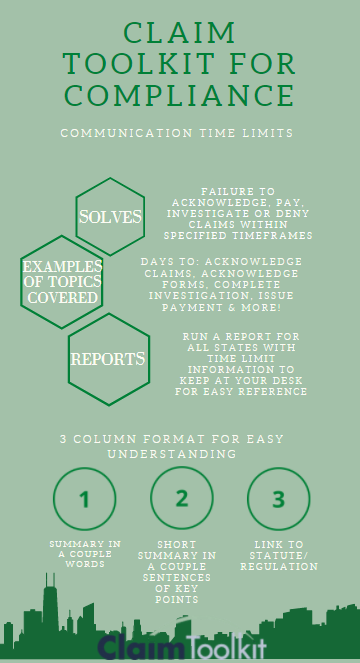

We are going to kick off with: Paying, investigating, acknowledging and/or denying claims outside of the specified time frames.

We’re sure that no is surprised that this is a top issue for insurers! As an adjuster, how many time frames do you need to keep track off? That’s why Claim Toolkit for Compliance create a Communication Time Limits chart.

This is one of our most popular charts as it outlines time frames for everything you need to know when handling a claim – in every state, plus DC.

How many days does the insured have to make proof of loss after a blank form is supplied by the insurer? For North Dakota, its 60 days

How many days does an insurer have to make a decision on claims/benefits within receipt of a valid and complete claim? In Colorado, 60 days

Claim Toolkit for Compliance can’t ensure that you meet these time frames, but we can give you all the information you need to try!

“You miss 100% of the shots you don’t take.”

When I don’t think my offer will settle the claim, I always remember that saying.

Take the shot. Make the offer.

If it is an auto case with a comp neg split, your offer effectively puts the claimant carrier on notice of your position: You’re not paying 100%. This really speeds the subrogation process because the other side is far less likely to ‘Just Say No’ when it is reported to them as having shared responsibility.

If it is a represented claimant, the attorneys have the duty to take the offer to their client. You never know people’s motivations. It has happened more times than I an count that the client overruled the attorney and took the money. Take the shot.

If it is a convoluted commercial question, your offer stakes your ground on where your coverage and liability applies.

Once I made a really low offer on a suspicious BI claim where there was clearly an accident – but not as clear was if the claimant was in the car at the time. Their immediate acceptance was proof enough for SIU involvement leading to two arrets.

Other good things happen when you put your position out there:

Challenges can fine tune your argument;

Adversaries are forced to respond; and

The first offer generally results in a stronger position to dictate the terms.

So, even if you are pretty darn sure the claimant won’t take it – make the offer.

You miss 100% of the shots you don’t take.

Mark’s Claims can be denied! Got a better way? Let us know!

Why would you NOT make an offer?

In our last Mark’s Claims, we started this series on how to disagree without being disagreeable.

If you are a professional golfer, you practice a lot of putts. If you are a professional basketball player, you’re going to shoot a lot of free throws. These are the skills needed to succeed.

As a professional adjuster, since our job is protecting a large pile of money from people who don’t deserve any or all of it that they want, we are going to have a lot of disagreements.

Think of it like putting or free throws: you need to disagree well to succeed as an adjuster – it’s a basic skill you should constantly practice.

This blog is all about giving you actionable items – simple little tips to improve your performance as a claims professional.

Here’s another disagreement tip from the world of Visual Linguistics.

Visual Linguistics is the science of studying how the mind reacts to words and images. Simply put, to further our understanding we turn words into images and imagines into words.

As an expert in disagreeing, we want to avoid words that provoke images of conflict and instead use words that visualize the absence of conflict. This brings me to the star of this column:

“As it turns out.”

What do you “see” when you hear or read these words?

The visualization of this phrase conjures the image of a near -miss, a collision that didn’t happen or that a turn occurred before impact.

Another popular visualization is a surprise ending – that the souffle didn’t quite rise or the new bedroom paint didn’t work like you expected.

But it is not judgmental in any way: Might not be what you expected but it’s just the way things turned out.

Perfect for a disagreement professional!

Let’s try it!

“As it turns out, both regulators and the repair industry know that aftermarket parts are a safe and economical way to put your car back in pre accident condition.”

“As it turns out, the medications that you submitted for reimbursement are for breast cancer, not the accident, so they are not eligible for reimbursement.”

“As it turns out, your policy doesn’t cover the custom awning you installed without an additional premium.”

“As it turns out, the value of the damage is significantly less than first reported.”

“As it turns out, the law places some responsibility on you as the icy sidewalk is considered an ‘open and obvious’ hazard.”

When you speak, people are seeing images in their mind. Draw an image of the avoidance of conflict: use “AS IT TURNS OUT.”

Stay tuned for more tips on how to disagree!

I love the Godfather series of movies. One of my favorite scenes is the one where Al Pacino is lectured: “This is the business we have chosen.”

If you are a working adjuster, someone will disagree with you on every day that ends in a “Y”.

This is the business we have chosen.

It follows that being able to hold your own in any argument is a necessary survival skill. Over the next several weeks, Mark’s Claims will be here with simple – but effective – techniques on how to disagree without being disagreeable.

Today’s is the simplest of all:

Never use the word “But”. Instead, use “And”.

Social science research at the Ottawa Institute for Advanced Linguistics found using the conjunction “but” was far less effective (as much as two thirds less effective) in resolving a dispute, compared to the conjunction “and”.

In the experiment, students received a false but official-looking notice that they would not be allowed to graduate because they had unpaid tuition. They were told to visit an office bringing proof of payment where the researchers waited. In each case, regardless of the student’s proof, they were met with 1 of two statements:

“But you can’t graduate without paying all of your tuition.”

Or

“And you can’t graduate without paying all of your tuition.”

The subjects were evaluated on their reactions to each statement. Statements with “but” were evaluated to be 64% LESS EFFECTIVE than statements with “and”. “However” showed a meager improvement to 47% LESS EFFECTIVE.

My own experience proves this technique works! Let’s try it!

“I know you believe your car to be worth $10,400 and the market value is $10,200.”

“Yes, you indeed had the right of way and you were too fast for the conditions based on the law.”

“Your demand of $55,430 remains a mystery to me and the actual value of the case is not even the same number of digits.”

So simple!

Get rid of “But“. Use “And” instead.

Stay tuned for more tips on how to disagree!

It is amazing the amount of information a claim’s adjuster needs to know. I see all the information we have in Claim Toolkit for Compliance and it blows my mind that one person needs to know all this information to handle a claim! Let alone, handle different types of claims in different states that have different laws.

When I started working in the property and casualty insurance realm, I looked for a class that would give me an overview of what a claim’s adjuster needs to know. Surprisingly, it’s a very hard class to find! So, if you are a new adjuster or if you’ve switched territories, what kind of training do you get? Do you have a cheat sheet that the company provides or is passed down from another adjuster? Is your desk covered in sticky notes?

Would it be handy to have a chart with specific information by state? For example, a chart with the med pay laws in Alaska? Or, a chart that details the laws around fraud in California? Claim Toolkit for Compliance has just this! I have learned SO MUCH by typing in key words in a search bar and having a chart populate based on that key word. Then, I select the chart I want to see the laws and regulations around the topic in a way that I actually understand.

Yesterday I met with a manager to give a demo of this product. Multiple times she said, “I wish I had this product over the last 20 years. It would have made my life so much easier!” I think we all do.

Some examples of our top utilized charts are: General Duty of Care, Statute of Limitations, Communication Time Limits, UM/UIM and No Pay/No Play laws. This is just the beginning – we have over 60 different charts of information! If you are a new adjuster or new to a territory, we have a chart that is a made for you – State Compliance Overview. This gives you the top regulations you need to know when assigned a new state. Best part about this, you can download the chart and print it off. Just hang it on your wall by your desk to easily reference it at any time. *We do recommend reprinting it weekly as we are always updating the information with the newest regulations.

You tell us, as a claim’s adjuster, what is it that you need to know? How do you find that information? For Claim Toolkit, if we are missing information that you’re looking for – we add it! Just think…how much time could you be saving by entering a word into a search box to find the information need? How much faster can a new adjuster get up to speed? I’m going to leave those questions there for you to ponder…

Need to reach someone in a hurry but can’t track down a phone number?

If you have their address, use one of the many online reverse directories to find numbers for neighbors and call them! A recent Gallup Survey said 72% of all Americans would consider passing information to a neighbor – but only if it was a “clear benefit” to their acquaintance.

The quality of these internet cross reference services seems to change with the wind but at Claim Toolkit, we current like https://www.411.com/reverse-address.

Lets acknowledge that this technique won’t work in every neighborhood and cold calling is tough to do. But you can do it and you should! It will increase your contact percentages – guaranteed. Surprisingly, apartment building can be fertile grounds.

In the days where we can easily Venmo someone a cup of coffee, managers should think how they can empower their claims reps to thank people who help.

My best success has come when I’ve given a quickly spoken request that emphasizes that I am not a salesman and their neighbor needs my help. I string everything together, talking fast – and hope they don’t hang up.

“This is Mark Fay with Acme Insurance on a recorded line. This is not a sales call. Hey, do you know Sue and Bob across the street? I’m their insurance adjuster. I don’t have their cell, could you get them our number?”

“Mark Fay with Acme Insurance, not a sales call. Did you notice Bob’s silver Mazda across the street was damaged? We’re the insurance company responsible – can you have him call us?”

“Mark Fay adjuster with Acme Insurance here – not a sales call. We’ve been trying to reach your neighbor Sue in Unit A1 to take care of some medical bills she has, could you stick a note on her door? Happy to send you $5 for a cup of coffee.”

While social media and snail mail are also effective tools, when you need to reach someone in a hurry, call people who live or work near them.

Like a good neighbor, many Americans will pass your info on.

Try it!

Mark’s Claims can be denied! Got a better way? Let us know!

Why would you NOT try to call a neighbor?